Making the incorrect decision might lead to a significant loss because real money is involved when purchasing stocks and options. That’s why Options Backtesting Software is required for successful trading.

Due to this vulnerability, traders use trading strategies based on various standards and guidelines that correspond to the demands and objectives of the market. Before entering the market, they experiment with several strategies.

Trading strategies are first tested on computers by traders while they study trading charts. To further evaluate their trading strategies against historical data, numerous manufacturers have created stock & options backtesting software as a result of technological advancements. Your trading strategy can be changed and your profits can be increased using the test findings.

However, different backtesting software strategies vary according to trading experience, open systems, nations, and other comparable factors.

Modern day traders can now generate significant profits in the options market thanks to cutting edge tools.

What options are there for backtesting?

Options backtesting is a great technique to evaluate the performance of your options trading strategy and make sure you are employing the best method for making wise selections when trading with real money. method.

Backtesting for options and stocks are two sides of the same coin. Options backtesting assesses a certain set of options trading criteria, which is the main distinction between the two.

Obtain complete information on trades that have been completed, drawdowns, risk/reward ratios, cumulative returns, success rates, and more.

What is backtesting software?

Backtesting software is used to evaluate the performance of any trading or investment strategy. Additionally, it aids in performance forecasting.

Backtesting software code is used to replicate trading techniques utilizing historical data from financial assets like options, stocks, and more.

To do this, we use several market scenarios and datasets to assess the returns of our model. Investment banks and financial advisors change numerous trading strategy components and evaluate the viability of trading ways to choose the optimal trading strategy based on historical data. Professional traders can also gather information on expected net profit/loss, market exposure, volatility, risk-adjusted returns, and risk-free returns using backtesting software.

Top 10 Best Backtesting Software for Options Trading-

Let’s examine the top 10 options backtesting software –

Sharing Concepts-

As artificial intelligence quickly takes over as the dominating trend in the stock market, Trade Ideas is the best backtesting tool for realizing its full potential.

Automated backtesting capabilities in stock analysis software let you examine historical occurrences to discover how specific trade ideas performed under various conditions.

OddsMaker is the name of the backtesting tool, which is an independent module included into the Trade-Ideas Stock Screener. Both a solo purchase and a Trade Ideas Premium membership are available for it.

The largest “event-based” stock alert backtesting available right now is this one. Additionally, combining our stock analyzer and backtesting tools combined ensures the detection of profitable trading ideas and real-time market analysis.

Traders can envision what would occur if they seized the chance as soon as it was offered. For backtesting functionality, there are no scripting or programming requirements, and it is quite simple to use.

Add integrated AI trading algorithms to your backtesting software solutions. Trade Ideas Pro offers thorough information on entry and exit signals as well as back tested trading performance.

Additionally, users of the Brokerage API can instruct the program to trade on their behalf based on predefined criteria. More crucially, market performance has been continually surpassed over time by AI algorithms.

Forex Tester-

The world’s most liquid financial market is the foreign exchange market.. Due to its greater volatility than other financial markets, forex trading is unique. You need a backtester when trading forex to show you how your strategy is doing in this very volatile market.

This tool, which is expert backtesting software for forex trading, demonstrates the effectiveness of your strategy when trading currency pairings as opposed to stock market values.

The findings are clearer and more useful for pinpointing areas that need development.

Forex Tester is a performance-oriented backtesting application as well. Thanks to our commitment to developing the greatest forex trading backtesting tools, Forex Tester is one of the most user-friendly solutions on the market right now.

Forex Tester charges a one-time price of $149 for the fundamental program. Unfortunately, the functionality of the basic tester is constrained. When combined with the program, the organization’s Super Data plan, which costs $29.99 a month, is excellent.

TrendSpider-

TrendSpider is another program for backtesting to take into account. uses charts and alerts to make technical analysis easier. To fuel your backtested technique, you can rely on crucial intraday data and more than 20 years of historical data.

By doing this, the model’s accuracy is increased and trading strategies that can underperform with real-time data are avoided.

The backtesting tool can also use practical trade-by rules to faithfully simulate real-world trading experience, making it appropriate for both long and short approaches.

You don’t need to know how to write a single line of code to construct technical trading rules because the software is chart-based (from minute to year). By mixing several indicators, price action trading signals, volumes, portfolio chart patterns, and more, you can use this to create your own strategy from scratch.

Since all of TrendSpider’s backtesting capabilities emphasize a visual user interface, it is a perfect solution for beginners as well.

Charts are also used to illustrate backtesting results, which makes it simple to identify top and bottom performers as well as other crucial data like automated trend lines, win rates, profitability, drawdowns, and more. I can manage it.

You can rapidly assess which trading ideas are most likely to succeed and which ones require further investigation as a result

Tickron-

Tickeron’s backtesting for stocks, ETFs, forex, and cryptocurrencies is automated and uses custom AI-powered chart pattern recognition and forecasting algorithms. When it comes to offering theme model portfolios, precise pattern-based trading signals, success probabilities, and AI confidence levels, Tickeron excels.

The trading platform developed by Tykeron compares human and machine thinking using a combination of artificial and human intelligence.

Additionally, it provides a comprehensive range of features and advantages customized to your investing preferences and geared toward day traders, swing traders, and investors. Tickeron generates trading recommendations utilizing AI concepts for pattern detection.

Use our pattern search engine to first look for stocks on the stock market that match a specific price pattern from our collection of technical analysis patterns.

Naturally, the trend forecasting engine considers the backtested history of all detected patterns when making predictions.

TradingView-

His TradingView receives almost 200 million monthly visitors, making it one of the most well-known trading-related social networks worldwide.

TradingView provides a variety of free charting and screening tools for financial products traded on almost all international exchanges.

TradingView also provides cutting-edge backtesting software solutions supported by worldwide market access and a range of trading indicators and assets (stocks, forex, cryptocurrencies, etc.).

On the platform, numerous backtesting scripts and methods are available. Though many of them are free, bear in mind that if you want access to cutting-edge technology, you’ll need to pay.

One of the key benefits of TradingView’s backtesting tools is their user-friendly design. Results reporting is excellent. It includes data on the profitability of the strategy, including net profit, drawdown, and profitable trades. For convenient visual reference, trades are clearly shown on the chart.

We advise selecting the Pro and Pro Plus editions of TradingView if you intend to use it for more sophisticated backtesting and trading analysis.

This is due to the fact that it offers outstanding customer support, access to real-time intraday data on almost any asset, and a large variety of charts, indicators, and trading signals.

Every day, more than 2,000,000 users submit ideas and trading strategies that are either free to use or available for purchase. One excellent feature of TradingView’s backtesting tools is this.

Additionally, everyone in the community aspires to have better trading performance so that we may all work together to raise the bar.

This is due to the fact that it offers outstanding customer support, access to real-time intraday data on almost any asset, and a large variety of charts, indicators, and trading signals.

Every day, more than 2,000,000 users submit ideas and trading strategies that are either free to use or available for purchase. One excellent feature of TradingView’s backtesting tools is this.

Additionally, everyone in the community aspires to have better trading performance so that we may all work together to raise the bar.

Metastock-

The independent broker-neutral platform MetaStock effectively combines advanced scanning, backtesting, and forecasting capabilities.

You can backtest your ideas on this platform using a variety of markets and instruments. Additionally, it provides the option to design and test complicated trading strategies and choose from pre-made backtest scenarios.

But don’t go overboard!

In reality, if you wish to develop sophisticated backtesting models, basic programming knowledge is necessary. The traders love how simply explained MetaStock presents the backtest data. The buy and sell signals of the software can be studied in depth.

This gives you a chance to investigate additional data, such as transaction range, length, profit and loss, and more.

Another element that draws many traders to MetaStock is the forecasting tools. An understandable probability cloud is produced by combining statistics and mathematics. This can be used to precisely calculate your stop loss and profit goals.

With the aid of our backtesting capabilities, we can find the most profitable uses for both reactive and proactive data.

Although the MetaStock interface is straightforward, it wouldn’t be accurate to describe it as having a strong retro style. If you are particular about the appearance of your program, there are much better backtesting tools available.

A Trading station-

The main reason TradeStation is well-known is because it is a leading day trading broker with commission-free trading. It is possible to trade stocks, ETFs, futures, options, cryptocurrencies, mutual funds, and more.

On the other hand, the high-end TradeStation desktop platform’s extensive range of advanced features is frequently disregarded.

You may backtest, hone, and fully automate trading strategies for a range of stocks and futures assets with TradeStation. The software also offers decades’ worth of historical market data, enabling you to create accurate models.

For designing, testing, and fine-tuning trading strategies in real-time without putting capital at risk, the combination of backtesting and simulated trading capabilities has proven to be the optimal prerequisite.

This enables you to unwind and take as much time as necessary to boost your self-assurance and increase the efficacy of your strategy before putting it into practice in the actual world.

Ninja Merchant-

The C# programming language was used to create NinjaTrader, a trading simulation system with sophisticated charting and backtesting features.

This platform, which mostly focuses on futures trading, is a terrific method to be ready for the live market with actual trades and expertly compiled market data.

One of the top backtesting programs in terms of functionality is NinjaTrader. Users of the platform have access to numerous historical feeds, advanced charting and analysis tools, hundreds of indicators, and tens of thousands of third-party add-ons and apps for even greater customisation.

The platform’s developers promise limitless assistance, ongoing access to investing guidance, and frequent webinars for training.

The built-in simulated trading mode on NinjaTrader can also be used to develop profitable trading techniques.

Additionally, you get access to a strong engine that enables you to completely address all flaws in your practice environments without cost thanks to the combination of simulation components and backtesting features.

Both new and seasoned futures traders use this program, which is among the top backtesting software options out there. You won’t be let down if you choose to persevere. The drawback is that connecting to your brokerage account requires you to get a NinjaTrader license.

Market Trader 5-

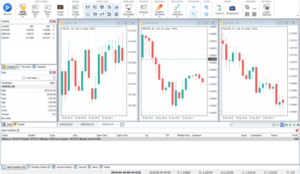

As the most popular Forex trading platform in the world, MetaTrader 5’s backtesting features unavoidably become more important.

You won’t be dissatisfied, despite a few small drawbacks like an old user interface.

His Metatrader Trading Strategy Tester tool allows users to backtest and hone their trading strategies before going live. The MetaTrader 5 forex backtesting tool now permits the employment of trading robots or “expert advisers.” MetaTrader 5 Strategy Tester enables testing of automated trading methods for people engaged in Forex trading activity. Complex mathematical and computational issues can be resolved by this function.

You can use historical data feeds, parameter optimization models, and other tools in a variety of testing modes.

Graphs, charts, and 3D models comparable to those created by data analysis tools like R and Python are used to elegantly present the output graphically.

The strategy testing function in Meta Trader 5 might not be the best choice for beginners searching for an easy-to-use FX backtesting tool.

That, however, is contingent upon your level of comfort with code. The vast strength and variety of the platform’s advanced capabilities can be intimidating for novice traders. However, it is undoubtedly one of the better solutions if you’re searching for a complex historical backtesting system. The best part is that MT5 enables total freedom and supports algorithmic autoruns.

Interactive Brokers-

Due to its stellar reputation and competitive pricing, Interactive Brokers distinguishes out as one of the best brokerages.

A significant segment of the market trusted the company because it was one of the first to establish a discount brokerage business model.

Owners of Interactive Brokers accounts can theoretically trade in many types of investments, including stocks, bonds, ETFs, futures, options, mutual funds, and foreign exchange.

The platform has a thorough assortment of more than 30 cutting-edge trading tools created to satisfy the requirements of all market players. The fundamental backtesting processes from Interactive Brokers are included into a sophisticated portfolio builder tool.

It offers traders everything they require to base their investment ideas on fundamental data rather than technical analysis and evaluate the success.

Additionally, Interactive Brokers’ portfolio construction and backtesting tools are supported by world-class research and fundamentals, including rankings from top buy-side sources, analysts, real-time data and news streaming, equities reports, and more.

Once you’re satisfied with your strategy’s performance during the backtesting phase, you can execute actual trades with only a few clicks thanks to built-in direct market access.

Using Excel-

Moreover, Excel provides a backtesting function. It was the first commonly used tool for traders to build models for automatically executing trades.

The backtesting feature of Excel requires a solid knowledge of VBA. Excel formulas, for instance, can be used to perform basic stock or currency backtesting. If you choose to utilize Excel, you will have access to thousands of lessons on how to backtest, giving you all you need to become proficient.

Some brokers even incorporate Excel-based trading tools, including Interactive Brokers. You must install the IB Excel API in order to finish the straightforward procedure.

The disadvantage is that a platform created especially for backtesting and automated execution is more potent than Excel. It makes sense given that it’s not the major objective. Excel may not be the best backtesting solution, and it’s certainly not the most productive one, if you lack fundamental skills.

This is because the project has few restrictions and needs some time to set up and operate as standard backtesting software. However, this is the best option if you want to gain experience with conventional trading analysis.

Quant Share-

Recommended for quant-her analysts that value access to widely utilized user-generated ideas, constructing reliable automation systems, and need to know how to code.

QuantShare specializes in making it possible for quant analysts to share stock systems, as the name would imply. They have a sizable system market with a ton of stuff that can be tested and used. You have an infinite number of possibilities to test and practice with thanks to your programming abilities.

Additionally, it offers a point-and-click system implementation. The artificial intelligence integration of AI Optimizer is excellent since it enables the system to mix and match various rules to ascertain which ones go best together. Strong neural network-based forecasting models are also present.

Conclusion – Best Options Backtesting Software

Backtesting is essential as it allows you to try different risk management strategies and profitability scenarios to refine your approach and see which is the most balanced.

Moreover, it helps to find flaws in trading models. This allows you to address issues in your training environment and test the effectiveness of your strategies without investing money.

Traders and analysts are usually convinced that a backtested strategy is fundamentally sound and could be a viable option if it produces positive results.

Conversely, a strategy that does not perform well in backtesting will result in the author redesigning the strategy or abandoning it entirely.

People Also Read: Best Trading App in India

FAQ for Options Backtesting Software-

1. What is options backtesting software?

Options backtesting software is a tool that allows traders and investors to simulate and test their options trading strategies using historical market data to evaluate potential profitability and risk.

2. How does options backtesting work?

The software uses historical price and volatility data to simulate how a specific options trading strategy would have performed in the past. This helps traders assess its effectiveness and make informed decisions.

3. Why are options backtesting important?

Backtesting helps traders refine their strategies, understand historical performance, identify potential flaws, and make adjustments before executing real trades in the market.

4. What features should I look for in options backtesting software?

Look for software that supports various options strategies, offers customizable parameters, provides accurate historical data, includes risk management tools, and offers detailed performance analytics.

5. Can I test different types of options strategies?

Yes, reputable options backtesting software should allow you to test a wide range of strategies including covered calls, straddles, iron condors, and more.

6. Is it necessary to have programming knowledge?

Not always. Some options backtesting software provides user-friendly interfaces that don’t require programming skills, while others offer advanced customization through scripting.

7. How do I access historical market data?

Options backtesting software often comes with built-in historical data, or you may need to import it from external sources. Ensure the data is accurate and comprehensive.

8. Can I test strategies in different market conditions?

Yes, good options backtesting software should allow you to simulate strategies in various market scenarios, including trending, volatile, and sideways markets.

9. Can I factor in transaction costs and slippage?

Yes, advanced options backtesting software lets you account for transaction costs, bid-ask spreads, and slippage, providing a more realistic simulation of real-world trading.

10. Are there free options backtesting tools available?

Yes, there are both free and paid options available. Free tools may have limitations in terms of features, historical data quality, or strategy complexity.